How banks and fintech businesses can be made more futureproof and especially when it comes to risks management and particularly in terms of data. What do these have in common ?

In 2008 you had lot of banks filling in “The Wall Street Journal” and there’s global crash and often in 2008 that is called a great recession because the economic did not improve. And then again, this year (2023) there are a lot of bank failures in the U.S but the effects of it rippling across the world, the interested are rising, there are a lot of risk factors that seem to be overlooked and the failures that seen in the US market and reveal has got what is the implications for the global market.

Rohit says “So what do these two things have in common? In 2008 with those huge crash, 2023 right now when we also seeing this mass of failures? So is it lack of proper GRC (Governance, risk, compliance) practices ?”

“This is the core of public sector but it is the same for finance, any critical sectors actually have the same issues, health care, finance, and public sector, and so this fill is that we seen finance of the banking, is it because of lack of proper GRC practices ?” He added.

GRS has been focus on following things for some time especially in 2008 :

- GRC adoption has grown a lot in the past decade, and so a lot of banks have been invented risk and compliance system

- Regulatory events are also increasing and we had regulatory events increasing for 600% just in last than years that means that more regulations are coming, so more advisory from the central bank, more directions from the regulators, so we cant say that regulations is decreasing.

- Banks and Fis are also paying more attention to GRC.

“So why this problem still happening ? so we just saw that regulators are getting realizing more regulations, banks are more getting serious about compliance and regulations but we still have seen the same kind of the issues come up even 15 years after the first one.” Rohit said.

New Oak has advise $8 Trillion of assets, for over 200 finance institutions, and FinplusTech makes system including risks management system in senior management covering almost all major classes. So there’s a lot of knowledge in this organization since 2008 on this issues.

President, FinPlusTech Inc & CTO, NewOak Finance, Rohit Kumar explained “So, when we find that, yes the problems is in GRC but not in the way it is imagined to be. So we thought maybe it is not enough regulation, maybe it is not enough compliance, but banks are doing these things and they still have problems, and we have identified the basic problem into a non-general risks management, but specifically lack of what we called Tail End risks management.”

Tail End risks management is a kind of event all the risks factor that happen a lot maybe once in 10 years maybe once in 20 years, there is no data/no mortal for this risks, but they become very big effect on this banks and finance institutions. So we found of this lack of ability to manage tail end risks rather than normal risks, which is causing a lot of this problem in banking sector and reputation of the bank.

So, the problem exist when we at two levels :

- At a framework level in terms of how tail end risks was understood within the context of current risk management

- At the practical level, as well at a more practical level of how organizations managed risk information.

Framework inadequacy :

- At framework level is model are made for normal market conditions. The bank give it out this models and they put certain assumption in this models and then they stress test, how they do look if their good, their financial solved or not, etc. Regulators also do the same thing, they also internally stress testing, make sure that they are in good order. And this models are made for normal market conditions, but when it comes to tail end risk management, this models for normal market conditions may not apply.

- Within the framework, the mind-set is to develop this models to comprehend behaviour, because of the sparse datasets of extreme events mean most models cannot be constructed. So that’s on the problem become framework

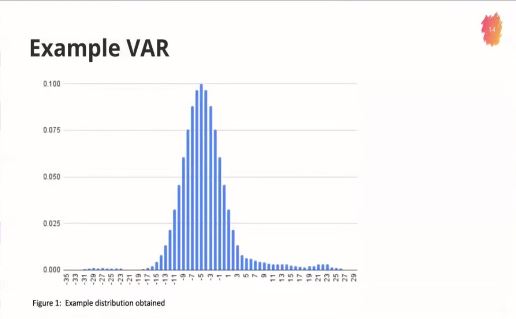

He highlighted that “One example called VAR (Value at Risk) this is how most companies, trading companies, financial companies measure risk of their portofolio. How did they measures the risk and this is important cause it diced back directly to public funds. So what they do is the use of measure like value at risk, VAR assumes that valuable many of the large example than the sample then towards normal distributions of losses or profit. This is a very good assumptions in most cases. This statistic principle tells us that when the large example of data it will then towards normal distributions, and that’s what VAR does, it kinda takes a portofolio, it tells us whats the probability in certain day, in certain week, in certain month of the loses being this much and the companies can then said that okay if this kind of loses okay, if this kind loses not okay.”

The problem again is the same what to explain before, this is okay for normal market conditions, so the model develop here which is based on the VAR is okay for the normal market conditions but breaks down during extreme events or when this tail end risks come through.

Practically, the second part adopted at the teritical level are :

- Number of regulatory events have grown 600% in last decade

- Information overload due to increase in the volume of data generated and ingested by risk management system.

- Important information is lost. As the data volume and number of events increase, it leads to a degrading “signal to noise” ratio for identifying and tracking important, high impact risks.

Rohit says “So the first thing I explain was that the teritical levels how the model are not typically subvision. The second one more practically level of companies managed they information and how the increase in amount of informations is not making it easier to identify this risk factors.”

Better framework to manage tail end risk, there are four steps :

- Introduce a framework which can assist in early identification of tail end risk and factors that may contribute to it.

- Integrate and associate all forms of relevant communication to the relevant compliance and risk assets. These should be accessible from a centralized portal.

- Develop processes and supporting tools to offer a multi-resolution view to the different roles in the organization

- Augment #3 by developing multi-level processes which assist in rapidly bubbling up required information to the correct level within the organization.

And here is proper model and data management is key :

- Use a heuristic based approach for the early tail risk identification

- Use data mining and AI to assist of associations between factors, risks and regulations/ governance principles which may not be obvious.

- Use standardized communication tools and metrics which are applicable across all risk classes to communicate risk at the highest levels with the option to drill down into detail as necessary.

“So we find that between the 4 factors that we identify earlier what we need, and this 3 tools are supporting things and data management we can really reduced the number of bank failure” He closed.