Who Are We ?

FinPlusTech essentially as a solution provided or technology provided for banking and financial institutions. New Oak finance in particular is a large advisory for financial institutions which help more than 200 institutions in their journey for risk management and cyber security as well and solutions. So all together, the New Oak has advise over $8 Trillion work of assets, more than 210 financial institutions serviced in North Amerika and Asia.

In 2008 there is a big problem in ”The Wall Street Journal” especially because of the collapse of Lehman, so the central bank had to bail a lot of institutions out, and it took about 2 years for the US to recover from this problem. New Oak was essencially called and requested by New York State Department of Financial Services to Ron D’Vari whose the founder and CEO of New Oak, to look at and to evaluate the bond insurers, municipal Instruments, corporate Credit for the best practices, risks and solutions to the problem. New Oak was called to evaluate the whole system and figure out where the problems was. And the finding essencially for the fundamental causes of the problem in 2008 are :

- Lack of Transparency in Financial Products and Subjectiveness of Base Information.

- Information was available but most people didn’t access to it

- There are lot of underlying characteristics of the system was not visible to the people. And will see that today the same problem exist, across where is NY or Indonesia, all this places.

- Inadequate models and model risk management

- There are assumptions based on long term averages and behaviour of housing prices

- Assumption of independence of house prices

- Role iof speculators was under-modelled

- Lack of Understanding of tail end risks

- This are risks that happen not very happen but when it happen it because a large problem for people involved

- Use of historical data which didn’st represent tail and risks and compounding domino effects

- Underestimateion of tail end events

- Loss of situational awareness due to inability to comprehend pace of events and cognitive dissonance between models and reality.

So, the problem have not disappeared, cause these are just a problems in the first half of this year in US. And just like Mark Twain says “History may not repeat itself but it often rhymes”.

“So our findings that we find before the informations transparency of model risks management and lastly about the way think their manage is very relevant today, this is even more important to the world of AI” Rohid said.

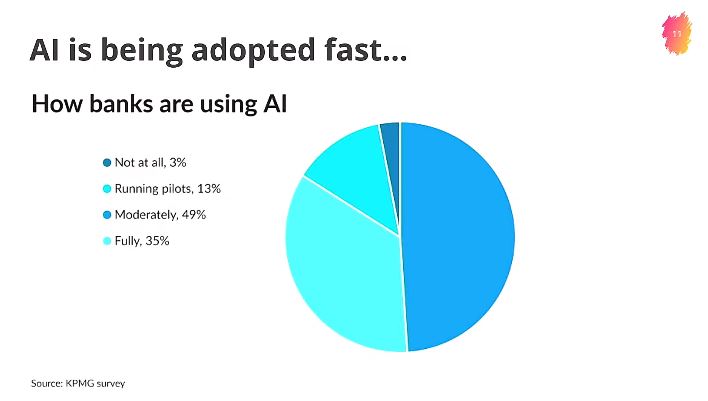

AI is being adopted fast about 35% of the banks that fully indegrade in AI system, more than 50% are considering it right now properly. So we see that over 97% that the bank and financial institutions are going to use AI very heavenly. And the AI introduce a lot more complexity into the problem, a 1000 times more data, non-linear behaviour, we don’t have causality, and that lot of systemic risks because of AI.

But the challenge is they (AI) sound new and actually very same to the old one, it means the models are not transparent, they based on available historical data which means they can’t models extreme events, things that can bring you down like the tail end risks, and they are not properly understood by domain experts and stakeholders.

“So the same problem in 2008 which led to huge financial crisis, the potential is there for the similar things because of the wide adoption of AI” Rohid said.

In critical areas, AI is being more used. So there are banks used it the most for modelling credit to give out loans, to give out credit, to give out money, and this are very critical industry.

So what’s the solution ? There are 4 key takeaways :

- There needs to be a greater focus on tail end risk management to approach

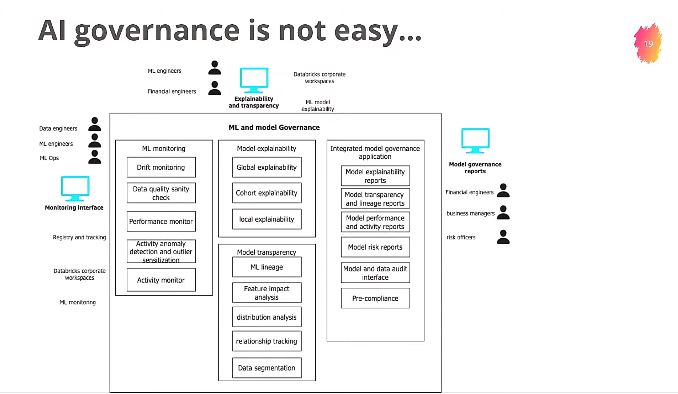

- AI Governance and explainability should be a fundamental part of business for fintech, banks, and financial institutions

- Domain driven constrainsts and checks need to be introduced in models via simulated data

- Standardized reporting and regulators to ensure situational awareness during crisis

And so there are progress that has been made :

- Monetary Authority of Singapore has come up rwoth the FEAT Principles

- European Union has come up with the draft regulation of AI act

Rohid says “But this is not nearly enough as fast, cause finance is a very fast moving industry with lot of critical areas. And AI governance is not easy cause these are just some aspects of AI Governance and most banks would not even covered 20% of this so its very important to get this in order.”

Similarly, Tail end risk management is not easy, if you go to any bank and essentially ask them :

- What is the sensitivity to your bank of risk factors ?

- When does the cost become non-linear to known risk factors?

- How do you model risks which are not captured by data ?

Lasly, Most of us in the large institutional banks will have no idea because there’s very little informations transparency. And so are cross domain experts, most finance people don’t understand AI, and most AI people don’t understand finance. He closed.